NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR DISSEMINATION IN UNITED STATES

CALGARY, ALBERTA – August 8, 2019 - Pieridae Energy Limited (“Pieridae” or the “Company”) (PEA - TSXV) has filed its second quarter (“Q2”) unaudited condensed interim financial statements and related management’s discussion and analysis (“MD&A”) for the three and six month periods ending June 30, 2019. Pieridae's unaudited condensed interim financial statements and MD&A are available on our website at www.pieridaeenergy.com and are filed on SEDAR at www.sedar.com.

Operational Highlights of the Quarter:

On April 1, 2019, the Company announced it had engaged Kellogg Brown & Root Limited ("KBR") to perform a review of an amended version of the previously prepared front-end engineering and design study for its proposed Goldboro LNG Facility. KBR will also conduct an open book estimate necessary for entering into a lump sum engineering, procurement and construction contract. The total cost for this contract is expected to be approximately $13.0 million. KBR’s work is expected to take several more months to complete.

On June 26, 2019, Pieridae took a major step forward in acquiring the natural gas needed to supply the first train (or facility) at the proposed Goldboro LNG export facility with the signing of a purchase and sale agreement (the “Agreement”) with Shell Canada Energy (“Shell”) to purchase all of Shell’s midstream and upstream assets in the southern Alberta Foothills (the “Assets”). The Agreement with Shell Canada includes approximately 28,623 barrels of oil equivalent per day (“BOE/d”), three deep cut sour gas processing plants: Jumping Pound, Caroline and Waterton, and 1,700 kilometres of pipelines in the southern Alberta Foothills region. Net annual operating income (“NOI”)[1] of the assets is approximately $60 million (based on Q1, 2019 rolling 12-months adjusted NOI). The acquisition is expected to close in the third quarter of this year.

The Shell asset acquisition will give Pieridae a better product mix, layering in more liquids and sulphur – creating a stronger business platform which will help protect the Company from overall price volatility. The acquisition is immediately accretive to the Company, makes Pieridae a major player in the Alberta midstream and conventional upstream natural gas industries, and sees Shell take an equity interest in Pieridae. The Assets align well with the Company’s existing Alberta properties, providing further consolidation of the productive conventional foothills natural gas pools. Potential synergy opportunities exist where consolidation of working interests in production and midstream assets compliment Pieridae’s existing core areas. The Assets consist of long life, low decline production, in the range of 10%, with very high liquids and sulphur yields – a match for the Company’s current and future needs. The Assets are well suited to the technical skill set that currently exists within the workforce of Pieridae. Existing production and new drilling inventory will provide significant new gas supply along with an extensive, well maintained, underutilized and sophisticated gas midstream system.

“We continue to make solid progress in working to close our deal with Shell Canada,” said Pieridae Energy CEO Alfred Sorensen. “This asset acquisition will mean we would have the majority of the natural gas needed to supply the first facility or train at Goldboro. And when the deal closes, Pieridae will be the largest gas producer in the southern Alberta foothills.”

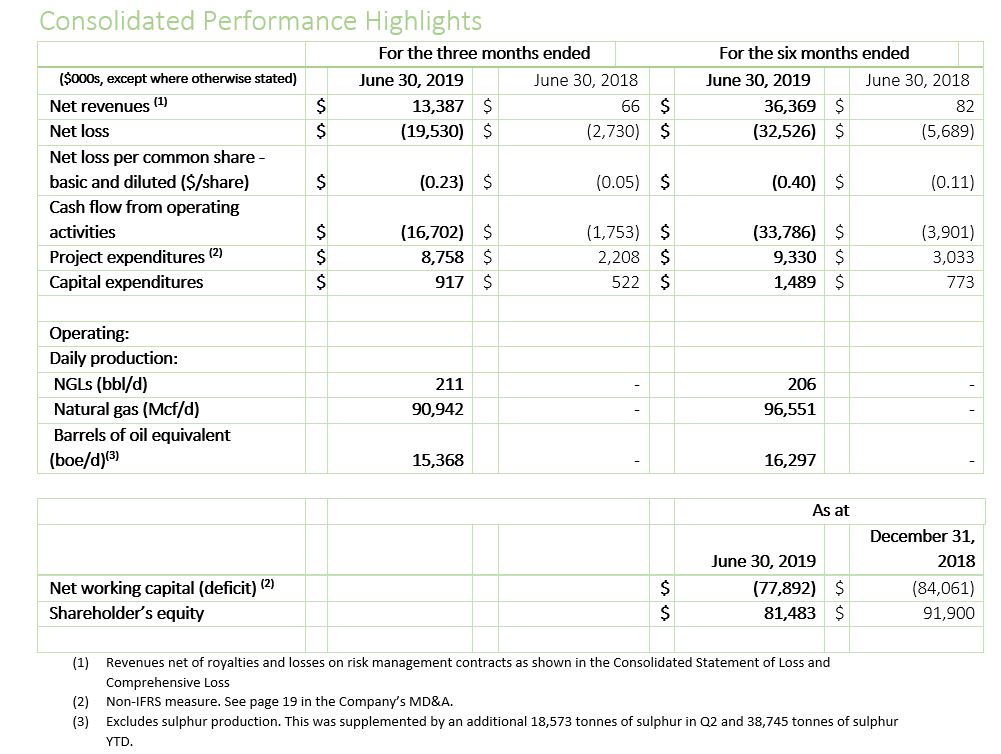

Volatile natural gas prices in Alberta impacted Pieridae’s bottom line for the quarter as prices were lower than they were in Q1 2019. The Company has taken steps to mitigate this impact, shutting in certain higher cost wells and implementing a hedging program to help blunt the current gas price environment. See the Company’s MD&A for further discussion of the Q2 results.

2019 Guidance:

With low natural gas prices resulting in production shut-ins, management is reducing the guidance issued in the Company’s Annual Report to average daily production expectations of 13,000 – 17,000 BOE/d, from the previous expectation range of 16,000 – 18,000 BOE/d. Production guidance excludes the expected Shell acquisition. The Shell acquisition is expected to increase production to a daily average of 45,000 – 50,000 boe/d in the late part of the year.

Pieridae’s 2019 upstream capital program has been curtailed and is now expected to be approximately $2 – 5 million as opposed to previous guidance of $8 – 10 million. With the focus now being on the completion of the Shell acquisition, management has reduced expected spending on Goldboro development activities to $20 million from previous guidance of up to $45 million.

In other Pieridae news, Chief Financial Officer Melanie Litoski will be leaving the Company August 9, 2019 to pursue another employment opportunity. Pieridae thanks Ms. Litoski for her contributions and wishes her well in her new role. The Company has initiated a search to fill the CFO position and, in the interim, these responsibilities will be handled by our Senior VP Finance & Risk, Rob Dargewitcz.

About Pieridae

Founded in 2011, Pieridae, a majority Canadian owned corporation based in Calgary, is focused on the development of integrated energy-related activities, from the exploration and extraction of natural gas to the development, construction and operation of the Goldboro LNG facility and the production of LNG for sale to Europe and other markets. Pieridae is on the leading edge of the re-integration of the LNG value chain in North America. Pieridae has 86,713,714 common shares issued and outstanding which trade on the TSX Venture Exchange (PEA).

For further information please contact:

Alfred Sorensen, Chief Executive Officer

Telephone: (403) 261-5900

James Millar, Director, External Relations

Telephone: (403) 261-5900

Forward-Looking Statements

Certain statements contained herein may constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable securities laws (collectively "forward-looking statements"). Words such as "may", "will", "should", "could", "anticipate", "believe", "expect", "intend", "plan", "potential", "continue", "shall", "estimate", "expect", "propose", "might", "project", "predict", "forecast" and similar expressions may be used to identify these forward-looking statements.

Forward-looking statements involve significant risk and uncertainties. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements including, but not limited to, risks associated with oil and gas exploration, development, exploitation, production, marketing and transportation, loss of markets, volatility of commodity prices, currency fluctuations, imprecision of resources estimates, environmental risks, competition from other producers, incorrect assessment of the value of acquisitions, failure to realize the anticipated benefits or synergies from acquisitions, delays resulting from or inability to obtain required regulatory approvals and ability to access sufficient capital from internal and external sources and the risk factors outlined under "Risk Factors" and elsewhere herein. The recovery and resources estimate of Pieridae's reserves provided herein are estimates only and there is no guarantee that the estimated resources will be recovered. As a consequence, actual results may differ materially from those anticipated in the forward-looking statements.

Forward-looking statements are based on a number of factors and assumptions which have been used to develop such forward-looking statements, but which may prove to be incorrect. Although Pieridae believes that the expectations reflected in such forward-looking statements are reasonable, undue reliance should not be placed on forward-looking statements because Pieridae can give no assurance that such expectations will prove to be correct. In addition to other factors and assumptions which may be identified in this document, assumptions have been made regarding, among other things: the impact of increasing competition; the general stability of the economic and political environment in which Pieridae operates; the timely receipt of any required regulatory approvals; the ability of Pieridae to obtain qualified staff, equipment and services in a timely and cost efficient manner; the ability of the operator of the projects which Pieridae has an interest in, to operate the field in a safe, efficient and effective manner; the ability of Pieridae to obtain financing on acceptable terms; the ability to replace and expand oil and natural gas resources through acquisition, development and exploration; the timing and costs of pipeline, storage and facility construction and expansion and the ability of Pieridae to secure adequate product transportation; future commodity prices; currency, exchange and interest rates; the regulatory framework regarding royalties, taxes and environmental matters in the jurisdictions in which Pieridae operates; timing and amount of capital expenditures, future sources of funding, production levels, weather conditions, success of exploration and development activities, access to gathering, processing and pipeline systems, advancing technologies, and the ability of Pieridae to successfully market its oil and natural gas products.

Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on these and other factors that could affect Pieridae's operations and financial results are included in reports on file with Canadian securities regulatory authorities and may be accessed through the SEDAR website (www.sedar.com), and at Pieridae's website (www.pieridaeenergy.com). Although the forward-looking statements contained herein are based upon what management believes to be reasonable assumptions, management cannot assure that actual results will be consistent with these forward-looking statements. Investors should not place undue reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and Pieridae assumes no obligation to update or review them to reflect new events or circumstances except as required by Applicable Securities Laws.

Forward-looking statements contained herein concerning the oil and gas industry and Pieridae's general expectations concerning this industry are based on estimates prepared by management using data from publicly available industry sources as well as from reserve reports, market research and industry analysis and on assumptions based on data and knowledge of this industry which Pieridae believes to be reasonable. However, this data is inherently imprecise, although generally indicative of relative market positions, market shares and performance characteristics. While Pieridae is not aware of any misstatements regarding any industry data presented herein, the industry involves risks and uncertainties and is subject to change based on various factors.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.